by Kelly Elliot | Sep 23, 2019 | Client Success Stories

SBEL is your solution when…you want to lower your interest rate and monthly payment. Situation: Matt & Kelly G. purchased their Orange County home several years ago. Hearing the chatter on the news about home mortgage interest rates coming down, they decided...

by Kelly Elliot | Apr 19, 2018 | Client Success Stories

SBEL is your solution when…as a newly divorced mom, just starting back in the work force, you want to refinance your previously joint home loan into your own name. Situation: Pauline was a newly divorced mom re-entering the work force. She had started a new...

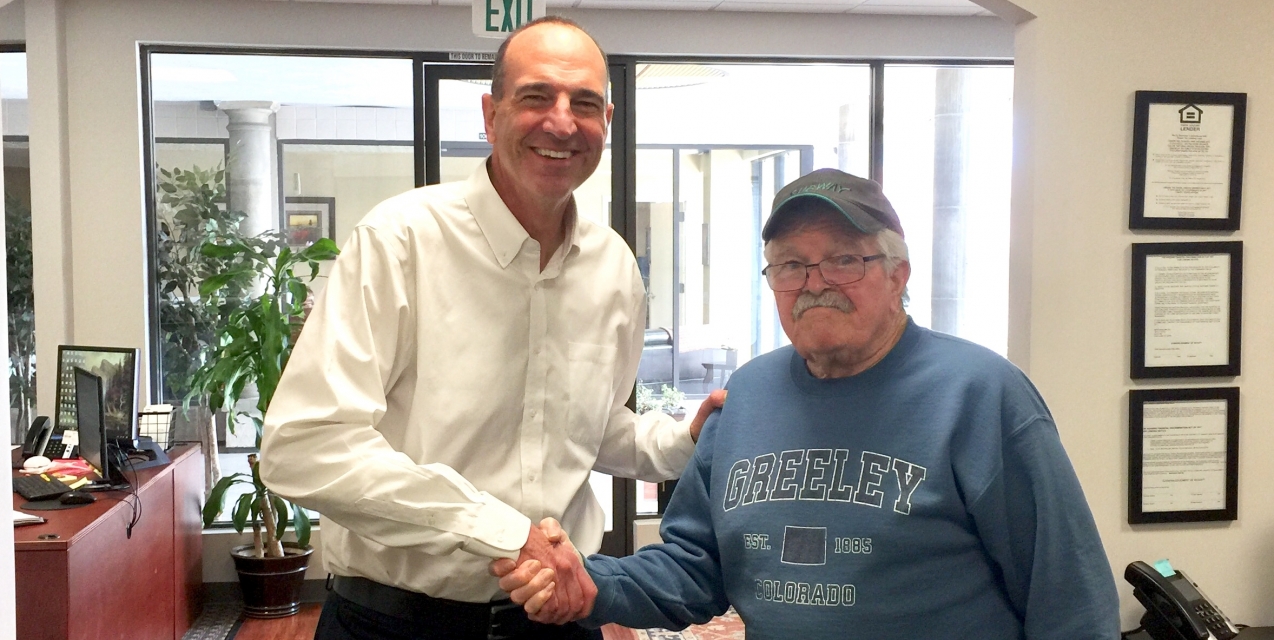

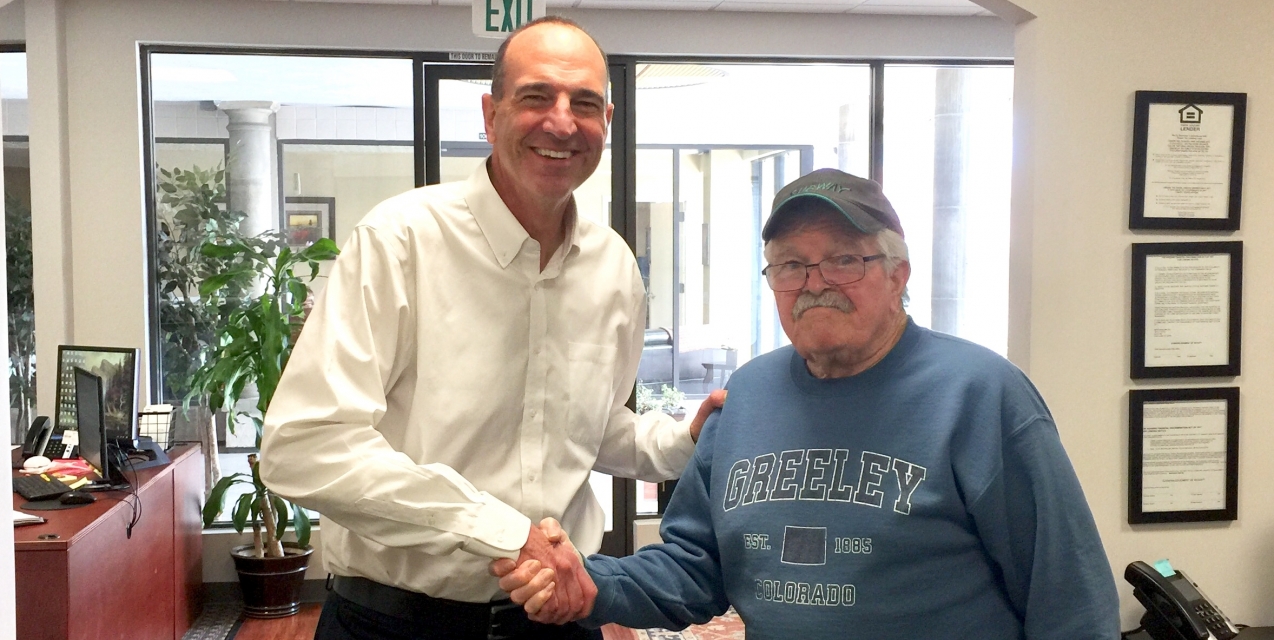

by Kelly Elliot | Mar 20, 2018 | Client Success Stories

SBEL is your solution when…you to want to live the rest of your retirement years in your beautiful South Bay home and no longer have to make a monthly mortgage payment. Situation: Albert & Carolyn retired to their beautiful home in the South Bay. They decided they...

by Kelly Elliot | Jun 20, 2017 | Client Success Stories

SBEL is your solution when you want to improve your cash flow, combine the first & second mortgages and finance some home improvement projects with a new home equity line of credit. Situation: John and Karen recognized that by refinancing their home they could...

by Kelly Elliot | May 26, 2017 | Client Success Stories

SBEL is your solution when…you want to consolidate your debts and improve your cash flow. South Bay Equity Lending, Loan Processor Lily will tell her story in her own words. Situation: “You never know what will happen until you make the call! I was lost in...